Mergers and acquisitions affect several key factors such as business, legal, human resources, intellectual property, IT, finance, and of course, business intelligence. When two different companies sign up for an M&A, it becomes challenging to confront the complexities in integrating dozens or hundreds of applications and IT systems. Your new mixture of Business Intelligence systems should not be a headache.A BI Fabric helps in easing out the whole process, streamlining the transition and integration of your BI systems from both companies. This blog will see how adopting a BI fabric becomes the best BI investment decision you take during an M&A. Mergers and Acquisitions always involve a huge amount of change management. By having a single BI Portal, the company can train their old and new employees how to access all of their reports from a single place, regardless of where the report is from (the parent company or the acquired company). If the company decided to retire a BI system (or many) and replace all the reports with a new BI system, it will be transparent to the users because they will still always go to their BI Portal to get their reports and they don’t really have to know or care if the report comes from the old BI system of from the new one.Consider a situation where the parent company decides to bring in a new BI system. Having a BI Fabric is certainly an advantage in situations like these which helps to ease out the BI integration and consolidation process.Even if another M&A occurs and technology changes, a BI fabric will make it easier and less disruptive to replace one BI tool with another.

Mergers and Acquisitions always involve a huge amount of change management. By having a single BI Portal, the company can train their old and new employees how to access all of their reports from a single place, regardless of where the report is from (the parent company or the acquired company). If the company decided to retire a BI system (or many) and replace all the reports with a new BI system, it will be transparent to the users because they will still always go to their BI Portal to get their reports and they don’t really have to know or care if the report comes from the old BI system of from the new one.Consider a situation where the parent company decides to bring in a new BI system. Having a BI Fabric is certainly an advantage in situations like these which helps to ease out the BI integration and consolidation process.Even if another M&A occurs and technology changes, a BI fabric will make it easier and less disruptive to replace one BI tool with another. During a merger or acquisition, by the time the parent company decides which BI System to keep and which must be retired, BI Hub can come to the rescue by saving time and effort. You can simply import all your BI reports from all your BI systems into BI Hub and decide later which to retain and which to retire.BI Hub enables teams to easily access any BI report and share it quickly with the teams and help significantly reduce the integration risk. With BI Hub in place, the parent company can take its own sweet time to decide which BI tool to stick with. BI Hub can also function as an audit tool for the BI Platforms to get BI usage statistics. It also ensures BI Governance by giving you complete details like who has access to the reports, their last login, and their last password change, and more from the audit User Section.

During a merger or acquisition, by the time the parent company decides which BI System to keep and which must be retired, BI Hub can come to the rescue by saving time and effort. You can simply import all your BI reports from all your BI systems into BI Hub and decide later which to retain and which to retire.BI Hub enables teams to easily access any BI report and share it quickly with the teams and help significantly reduce the integration risk. With BI Hub in place, the parent company can take its own sweet time to decide which BI tool to stick with. BI Hub can also function as an audit tool for the BI Platforms to get BI usage statistics. It also ensures BI Governance by giving you complete details like who has access to the reports, their last login, and their last password change, and more from the audit User Section.

The Challenge

One of the key projects during M&A for the BI team will be to decide how the new BI systems from the acquired company can be integrated into the parent company. There are few critical decisions that the CIO must make such as:- Which BI system should be retained from the acquired company?

- Which BI system needs to be migrated?

- Which BI system must be removed from the BI environment?

- Who should have access to which report & so on…

Adopt BI Fabric to your existing BI environment

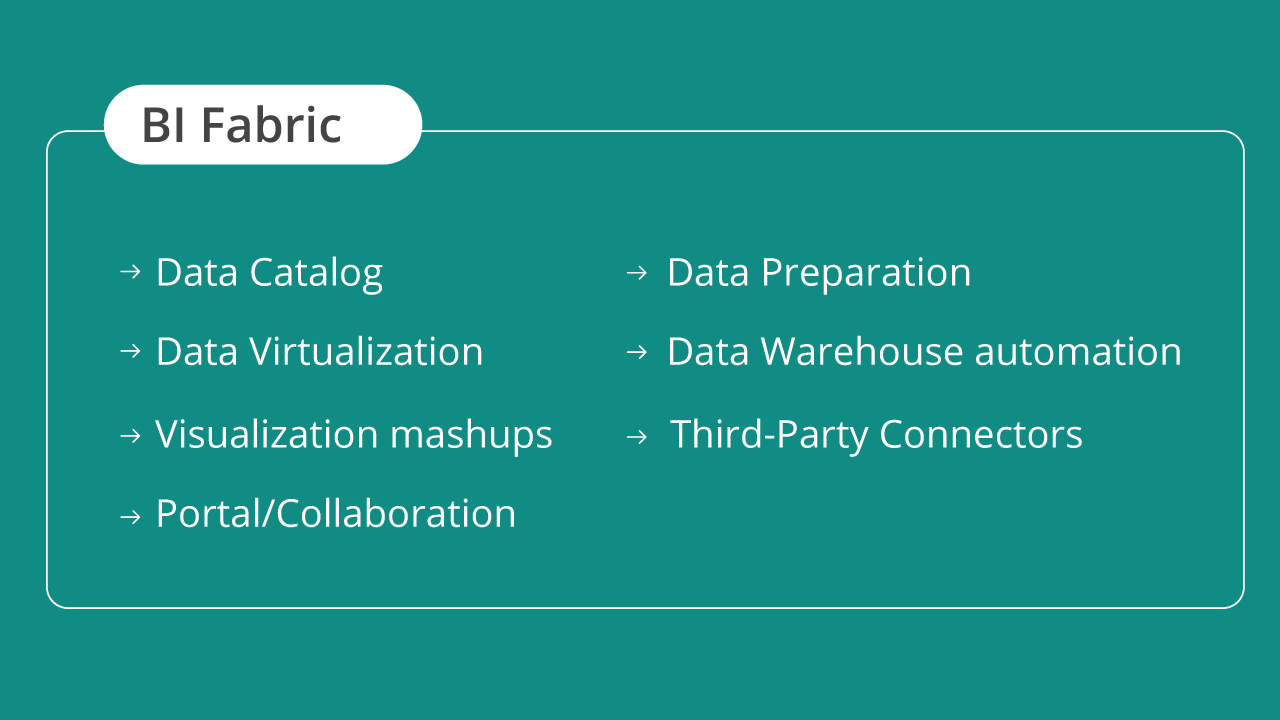

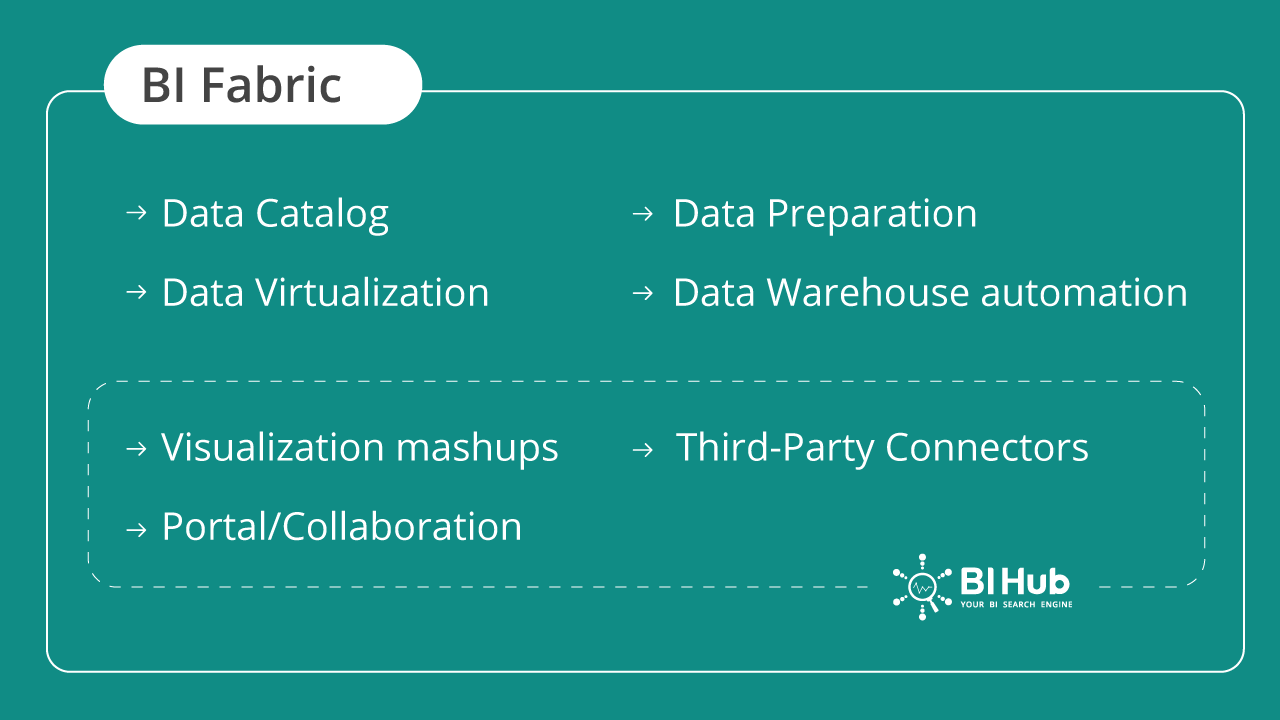

BI Fabric helps to stitch together multiple BI platforms using a common semantic layer in a unified portal. A BI Fabric is referred to as:“A set of technologies that allow application development and delivery pros, users, and architects to integrate, leverage, and reuse components from multiple business intelligence platforms.” -Forrester 2018A Forrester research paper titled “Use BI Fabric to Optimize Your Multivendor Business Intelligence Environment” by Boris Evelson categorizes the multi-platform BI integration into seven modules as shown in the image below:

Mergers and Acquisitions always involve a huge amount of change management. By having a single BI Portal, the company can train their old and new employees how to access all of their reports from a single place, regardless of where the report is from (the parent company or the acquired company). If the company decided to retire a BI system (or many) and replace all the reports with a new BI system, it will be transparent to the users because they will still always go to their BI Portal to get their reports and they don’t really have to know or care if the report comes from the old BI system of from the new one.Consider a situation where the parent company decides to bring in a new BI system. Having a BI Fabric is certainly an advantage in situations like these which helps to ease out the BI integration and consolidation process.Even if another M&A occurs and technology changes, a BI fabric will make it easier and less disruptive to replace one BI tool with another.

Mergers and Acquisitions always involve a huge amount of change management. By having a single BI Portal, the company can train their old and new employees how to access all of their reports from a single place, regardless of where the report is from (the parent company or the acquired company). If the company decided to retire a BI system (or many) and replace all the reports with a new BI system, it will be transparent to the users because they will still always go to their BI Portal to get their reports and they don’t really have to know or care if the report comes from the old BI system of from the new one.Consider a situation where the parent company decides to bring in a new BI system. Having a BI Fabric is certainly an advantage in situations like these which helps to ease out the BI integration and consolidation process.Even if another M&A occurs and technology changes, a BI fabric will make it easier and less disruptive to replace one BI tool with another.BI Hub to the rescue!

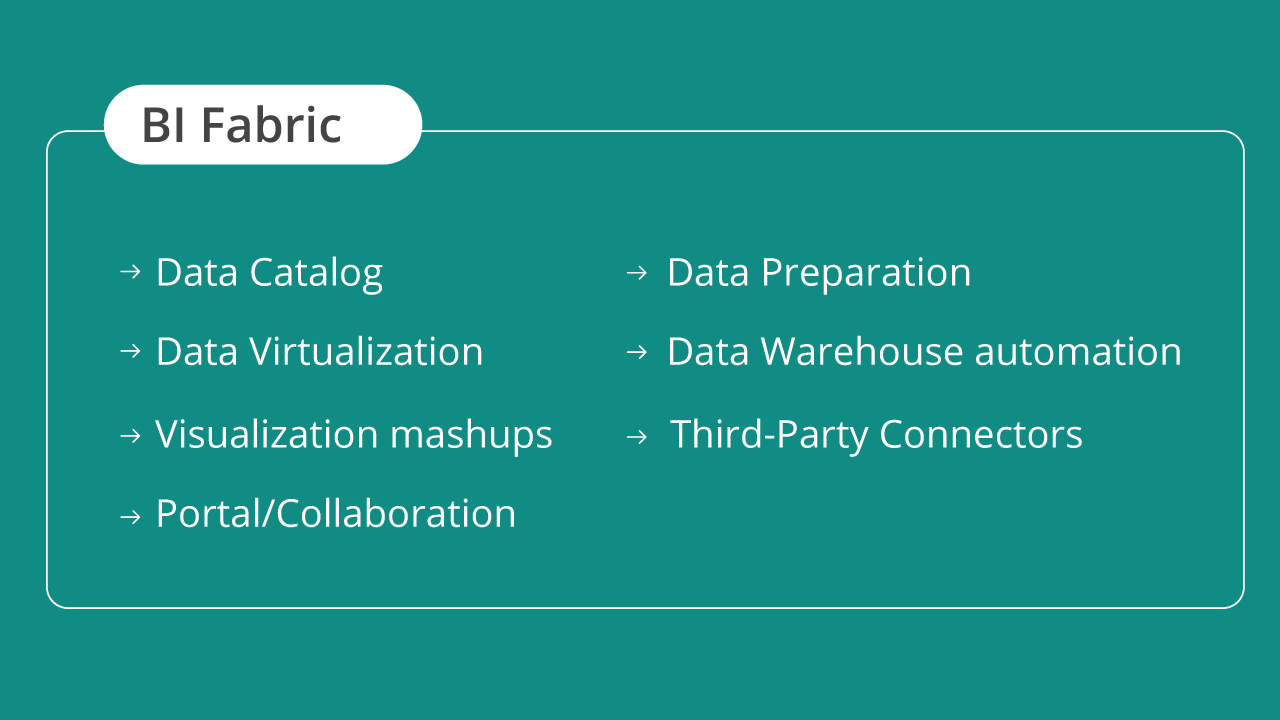

BI Hub is a BI Portal that helps you to unify all your BI reports into a single place. It also helps the BI users to get real-time access to all the reports spread across different BI systems. The image below shows the categories under which BI Hub falls in a BI Fabric. During a merger or acquisition, by the time the parent company decides which BI System to keep and which must be retired, BI Hub can come to the rescue by saving time and effort. You can simply import all your BI reports from all your BI systems into BI Hub and decide later which to retain and which to retire.BI Hub enables teams to easily access any BI report and share it quickly with the teams and help significantly reduce the integration risk. With BI Hub in place, the parent company can take its own sweet time to decide which BI tool to stick with. BI Hub can also function as an audit tool for the BI Platforms to get BI usage statistics. It also ensures BI Governance by giving you complete details like who has access to the reports, their last login, and their last password change, and more from the audit User Section.

During a merger or acquisition, by the time the parent company decides which BI System to keep and which must be retired, BI Hub can come to the rescue by saving time and effort. You can simply import all your BI reports from all your BI systems into BI Hub and decide later which to retain and which to retire.BI Hub enables teams to easily access any BI report and share it quickly with the teams and help significantly reduce the integration risk. With BI Hub in place, the parent company can take its own sweet time to decide which BI tool to stick with. BI Hub can also function as an audit tool for the BI Platforms to get BI usage statistics. It also ensures BI Governance by giving you complete details like who has access to the reports, their last login, and their last password change, and more from the audit User Section.